From MVP to Market Leader in Fintech. Help consolidate four distinct brands into one cohesive online identity.

Challenge

Partnering with Polar London, they aimed to create an MVP (Minimum Viable Product) website, marking the start of a transformative digital journey in the Fintech space.

Project Scope

Launch Location

Industry

Target Audience

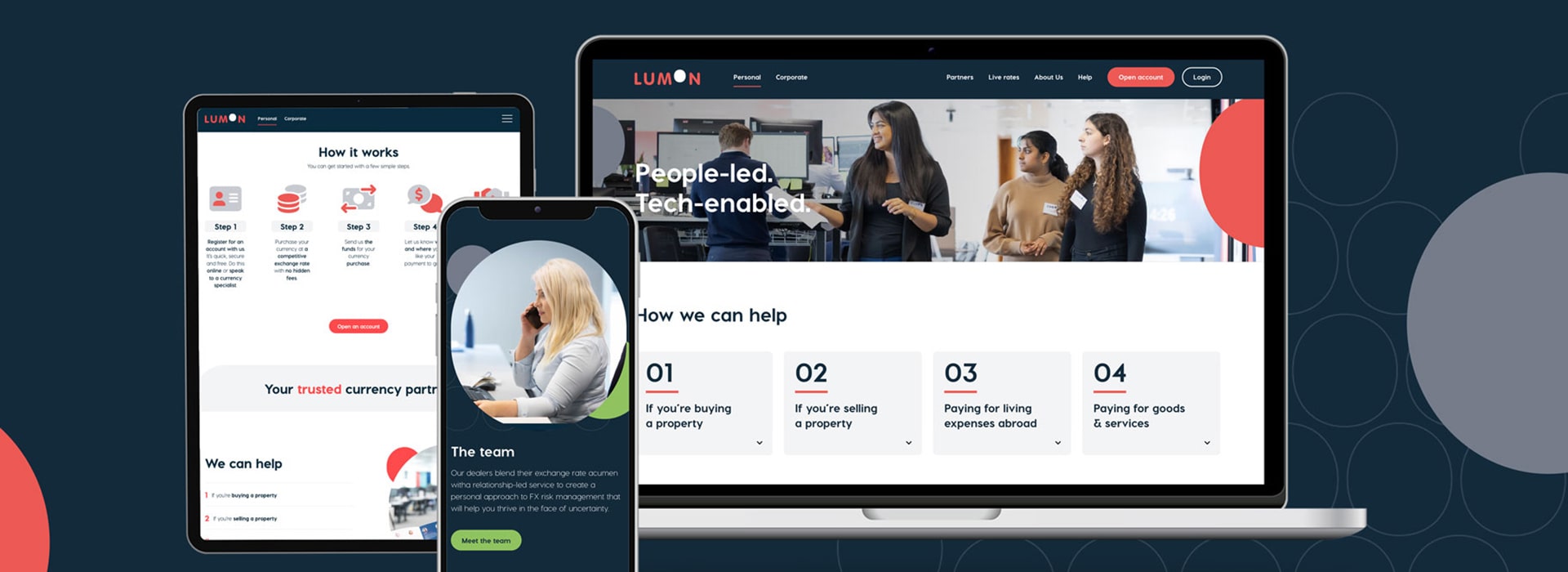

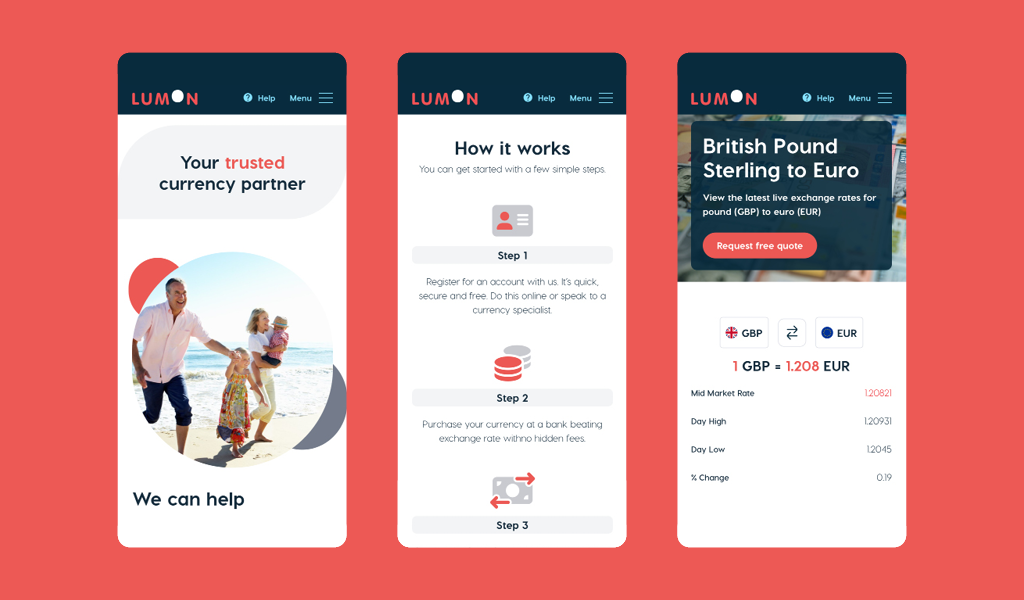

The Initial Brief – Lumon Pay’s Digital Evolution

The initial brief was a challenging yet exciting venture: to merge four separate entities into a single, powerful online presence. This initial phase focused on developing a streamlined, user-friendly website that served as a consolidated platform for Lumon’s diverse services. You can checkout the original case study here.

A Deepening Partnership

Over time, this partnership evolved, with Polar London becoming Lumon’s steadfast digital partner.

Our Approach

This collaboration has been marked by:

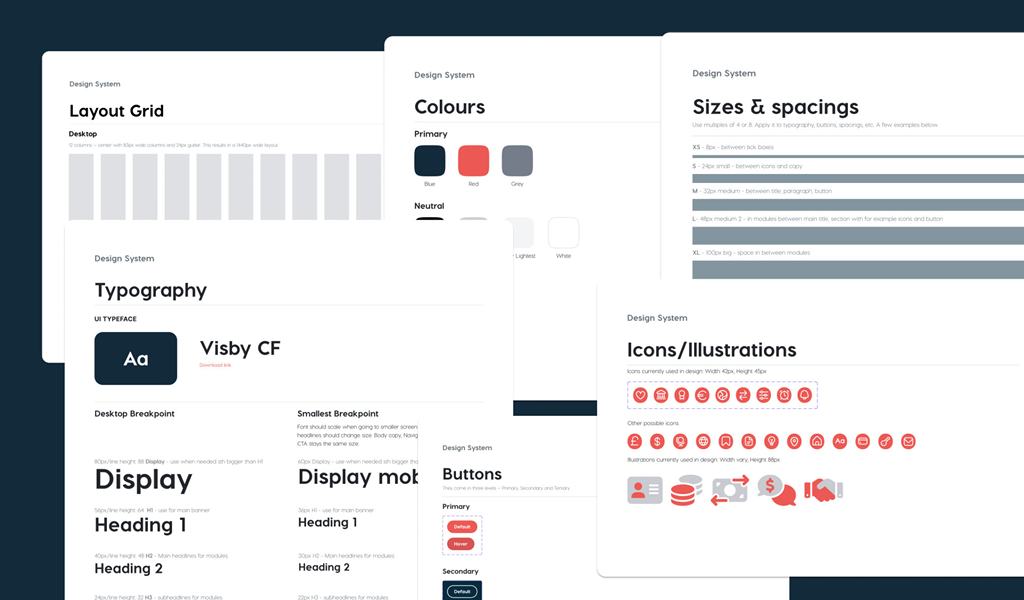

- A Dedicated Team of Digital Experts: Polar’s cross-functional team, comprising of UX specialists, designers, and technologists, has been instrumental in continuously enhancing Lumon’s digital footprint.

- Regular Strategy and Goal Setting: Working closely with Lumon, Polar sets quarterly KPIs, ensuring that every digital strategy aligns with Lumon’s evolving business objectives.

- Ongoing Maintenance and Optimization: Regular website maintenance, performance tracking, and reporting keep Lumon’s digital presence agile and responsive to market changes.

- Technical Advisory and Integration Support: Polar provides crucial counsel on integrating third-party APIs and platforms like MS Dynamics, ensuring seamless digital operations.

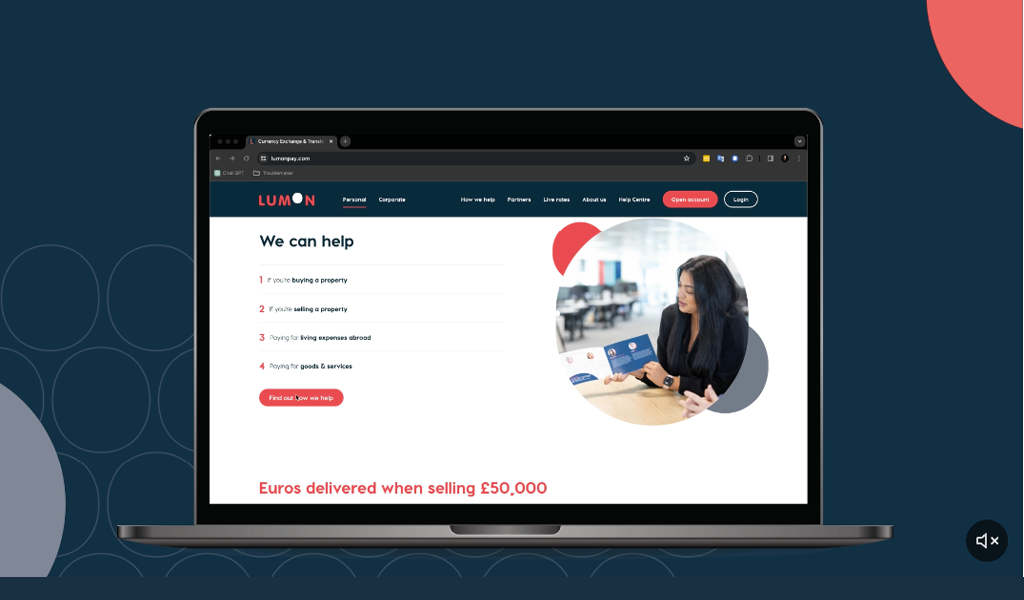

Targeted Audience Engagement and Content Strategy

Polar’s deep understanding of Lumon’s business enabled the identification and engagement of new audience segments. This involved:

- Crafting tailored content and dedicated web pages.

- Enhancing user experiences to cater to these newly identified sectors.

Services

Website: UX. Design, Development, QA, Technical council and Maintenance.

Results

The enduring partnership between Lumon Pay and Polar London has culminated in tangible, impactful results, reflective of the strategic focus on acquisition readiness in the Fintech sector:

Engagement and User Base Growth:

- Sessions: We strategically aimed to reduced session time, with improved UX. Resulting in a 2.85% decrease in session time, indicative of heightened user experience. (getting users where they wanted to be, quicker)

- Users: There was a 12.43% rise in users, demonstrating successful expansion in Lumon’s market reach.

- New Users: Growth in new users by 7%, highlighting effective outreach and market penetration strategies.

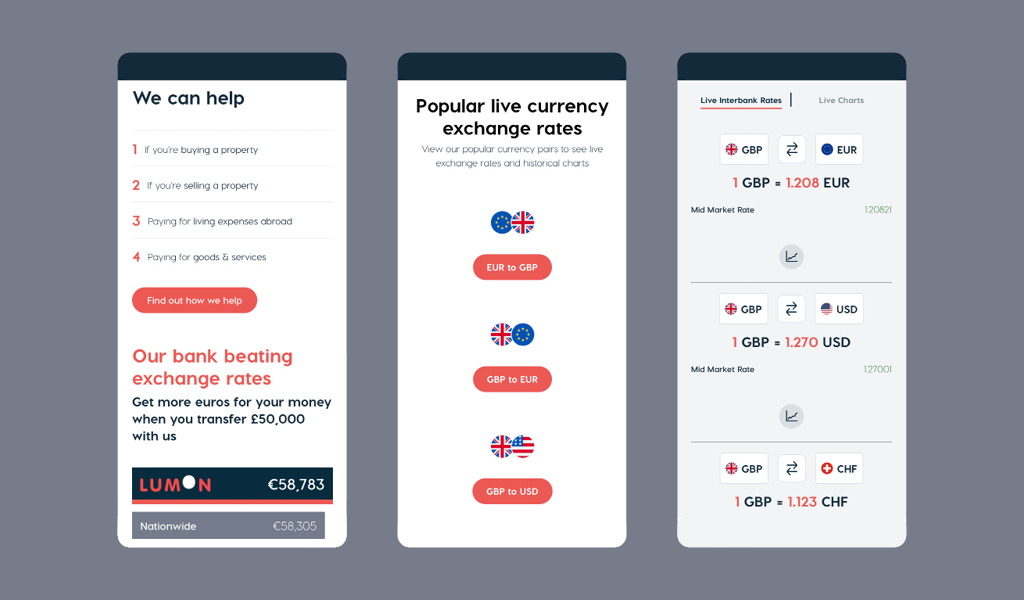

Enhanced User Experience:

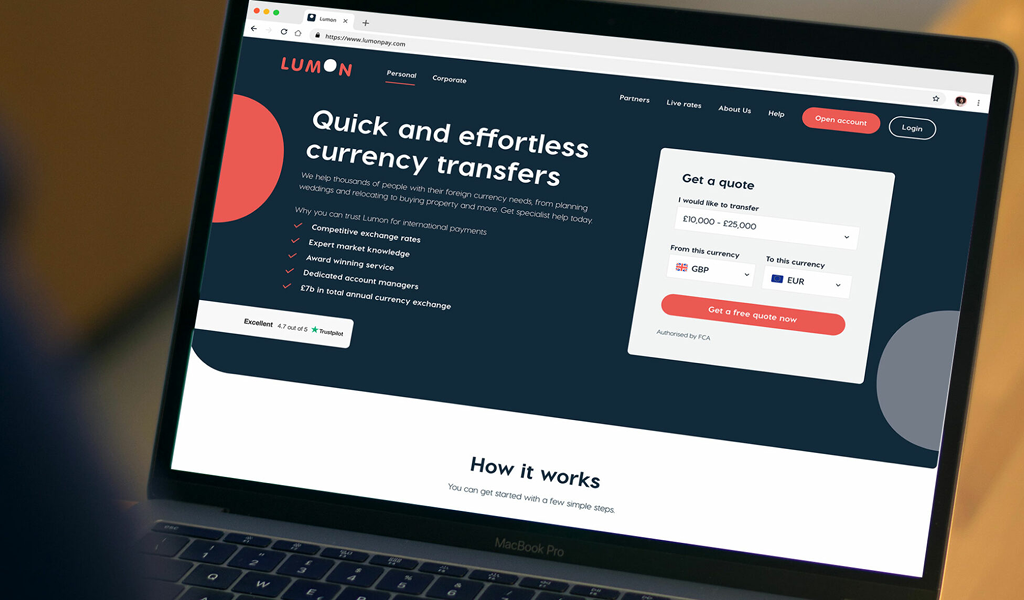

- Simplified navigation and improved mobile responsiveness led to a 15% increase in average session duration and a 42.44% decrease in bounce rate.

Strengthened Brand Messaging:

- Clearer value propositions and enhanced brand storytelling

Optimised Conversion Rates:

- Clear CTAs, streamlined account opening, and competitive pricing contributed to an increase in lead generation and conversion rates

*Results are based on 1 quarter comparison to another in 2023

Acquisition Objectives:

- The improved engagement metrics are not just numbers; they represent a strengthened foundation for any acquisition strategy. In the Fintech sector, where growth and consolidation are often achieved through acquisitions, these metrics serve as key indicators of the company’s health and attractiveness to potential acquirers.

- Lumon’s enhanced digital presence, facilitated by Polar London’s expertise, positions the company as an attractive target for acquisition, with a robust, active user base and a highly engaging online platform.

Conclusion